Gold vs S&P500

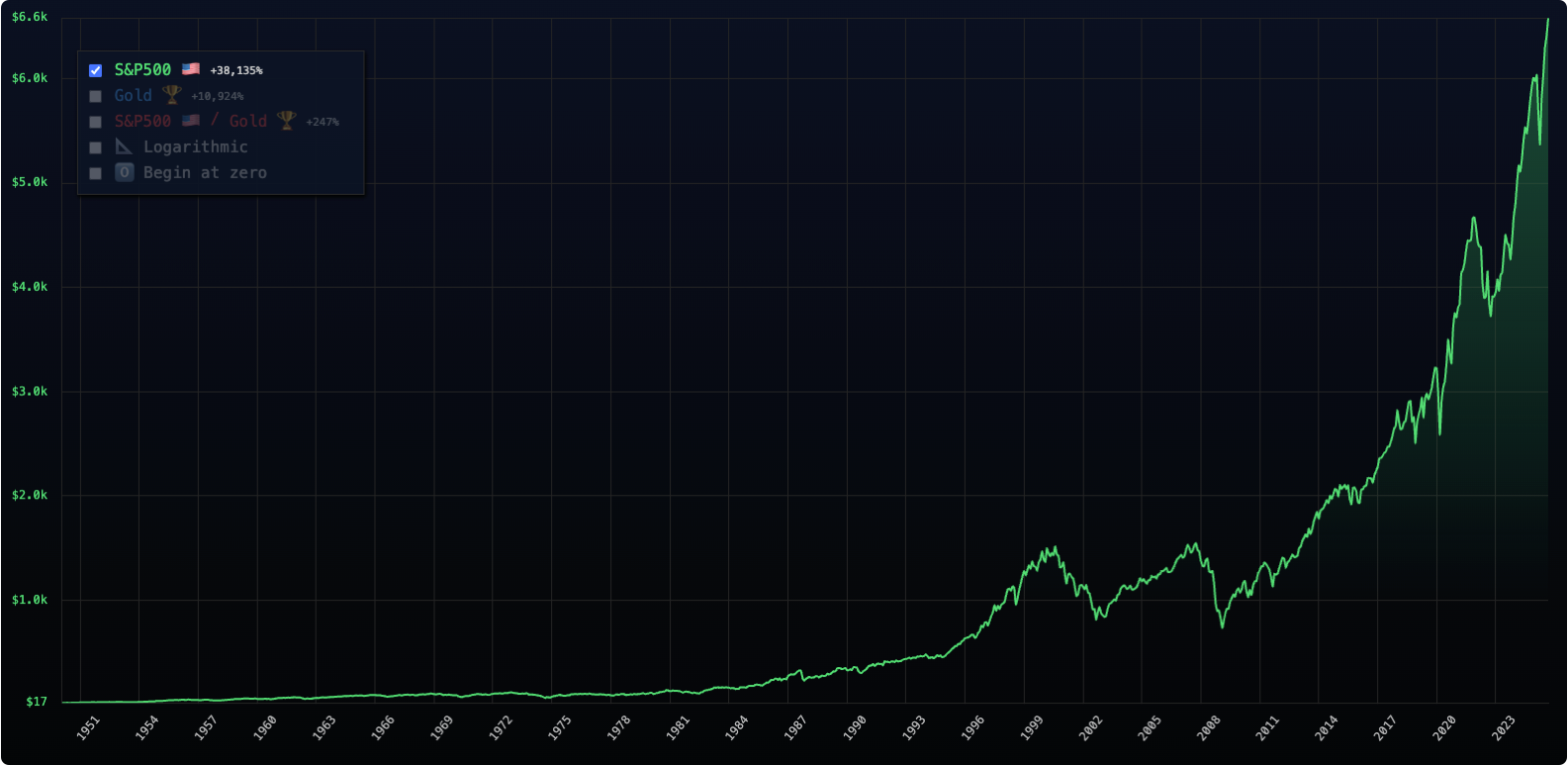

Here is a chart of the S&P500:

And a chart of gold:

And here is a chart of S&P500 measured in gold:

The images may be a bit small but you can play around with them yourself here.

Why am I looking at these charts?

Because I’ve seen some commentary online around the last chart: The S&P500 measured in gold instead of dollars.

And now I’m simply trying to wrap my head around what these charts mean.

This isn’t a political blog. I’m just here writing about tech, money, adventure, and whatever else I find interesting at the moment. But unfortunately, money seems to be very political at the macro level. So let me put it another way: I’m not trying to say what is right or wrong here. I’m just trying to figure out what this means for me as an individual.

Part of my confusion is in a narrative around the “SPX1 in Gold” chart: it is often followed by a story (or at least a general vibe) that we are in a depression. That the chart somehow shows were are not getting more productive as of late.

I may be missing something but I don’t think you can say anything about how productive or wealthy we are based on a chart only containing gold and stocks. Why? Because none of the items I buy on a daily basis are measured in those things. I don’t use Apple stock to buy my groceries. And I don’t carry around gold to pay for anything either. I can’t use any of these for my basic needs: food, shelter, security, etc.

To me, the question of whether is are getting wealthier obviously has to include some sort of “cost of living”: can I get more for my Gold and SPX today than I could 50/20/10 years ago?

And the answer to that is… it depends?

Some items have increased in value compared to the stock market and gold. If I want to buy Bitcoin I’ll get way less today than I would years ago. But again, I don’t use Bitcoin for any of my basic needs.

What about something closer to a need: housing.

Some houses have increased in value compared to Gold and SPX. But median house prices in the US have dropped significantly when measured in SPX (-90%) or gold (-76%). Rent has dropped too in SPX (-93%) and Gold (-75%).

We can also take a broader view with the “Cost of Living (US)” index over the last 20 years:

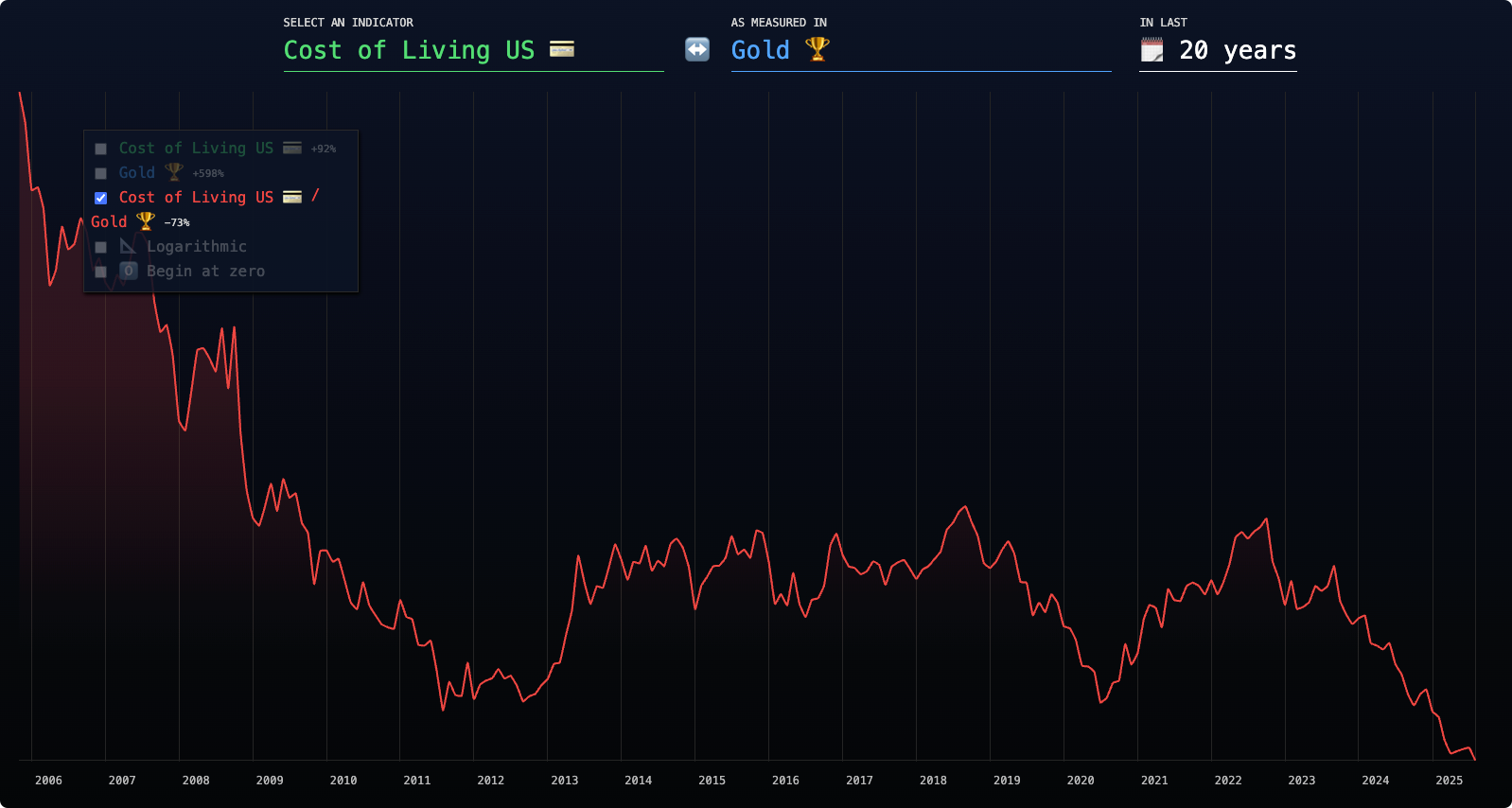

Measured in Gold the cost of living has dropped by 73%:

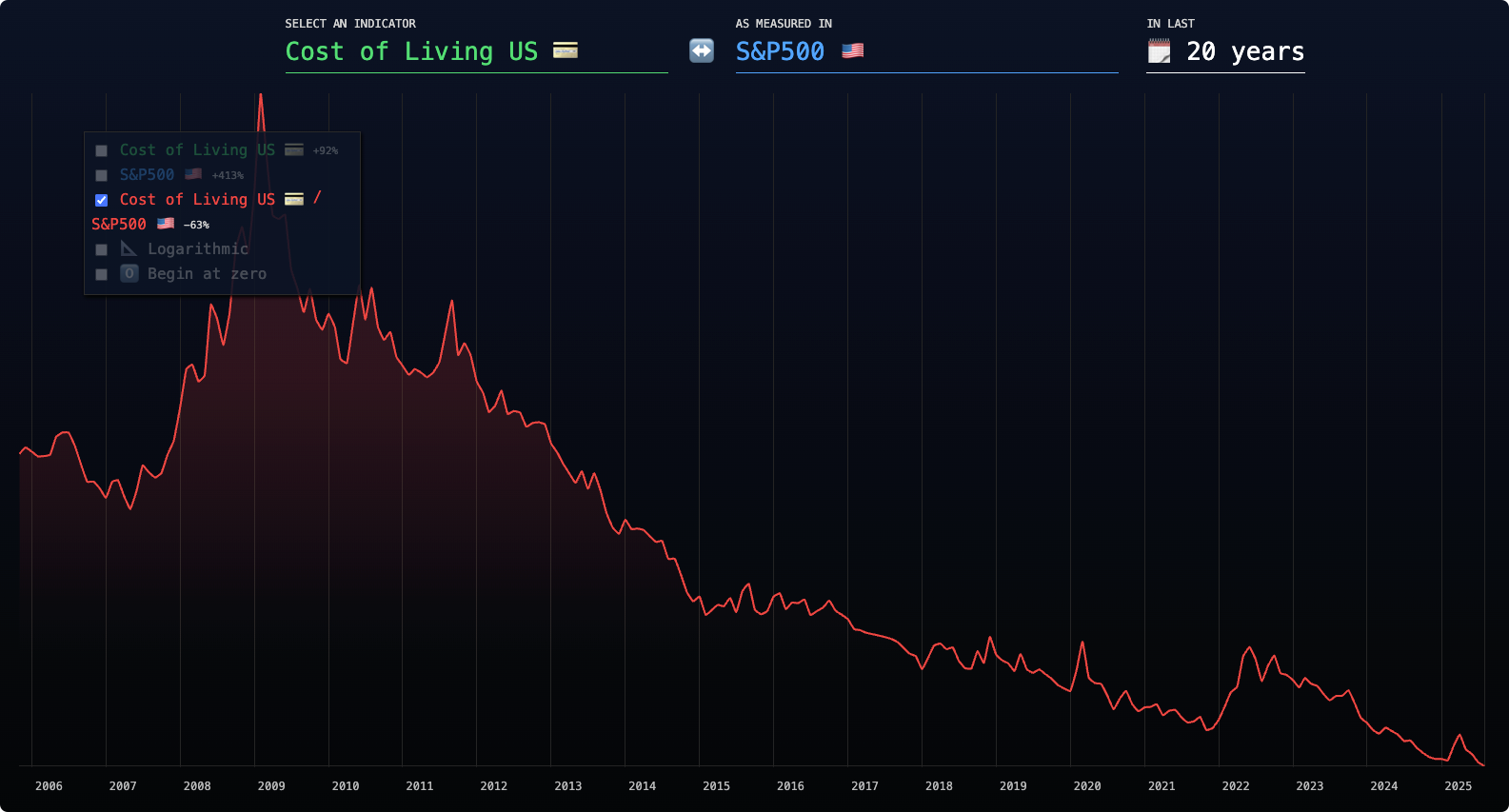

Measured in SPX the cost of living has dropped by 63%:

Those are some massive drops.

I know some of these metrics have their issues. It can be hard to accurately track cost of living, etc. And it also differs from region to region. I don’t live in the US so my numbers are different. But can I buy more basic needs today with gold and SPX than I could 10 years ago? I’m pretty sure the answer to that is a big yes.

The loser here is the US dollar. All of the things I have mentioned in this post: Gold, SPX, Housing, Cost of Living, Bitcoin, have gone up massively when measured in dollars. Which leads me to the two takeaways I have for myself:

- It is getting cheaper and cheaper to cover our basic needs (when measured in Gold or SPX)

- Don’t keep your savings in dollars (or any other fiat currency)

This is good. It means my strategy is still working: save a lot and invest your savings.

What about Gold vs SPX

This is an investment question. As nobody knows the future, nobody can tell you which is better for sure.

Cost of Living vs Income

The “living cost vs income” is a different discussion but it does look a bit grim that Cost of Living measured in Income Median has increased by 8% over the last 10 years. And in the last 20 years it has only dropped 8%. The longer trend over 50 years is better at -47% — but the clear downwards trend seems to have stalled around 2000.

Shoutout to @levelsio for the inflationchart.com website. All the images are from there.

Footnotes

-

The terms SPX and S&P500 are used interchangeably throughout this post. ↩